KNOW YOUR CLIENT/ANTI-MONEY LAUNDERING POLICY

Last updated: June 01, 2020

1. PURPOSE OF THIS KNOW YOUR CLIENT/ANTI-MONEY LAUNDERING POLICY

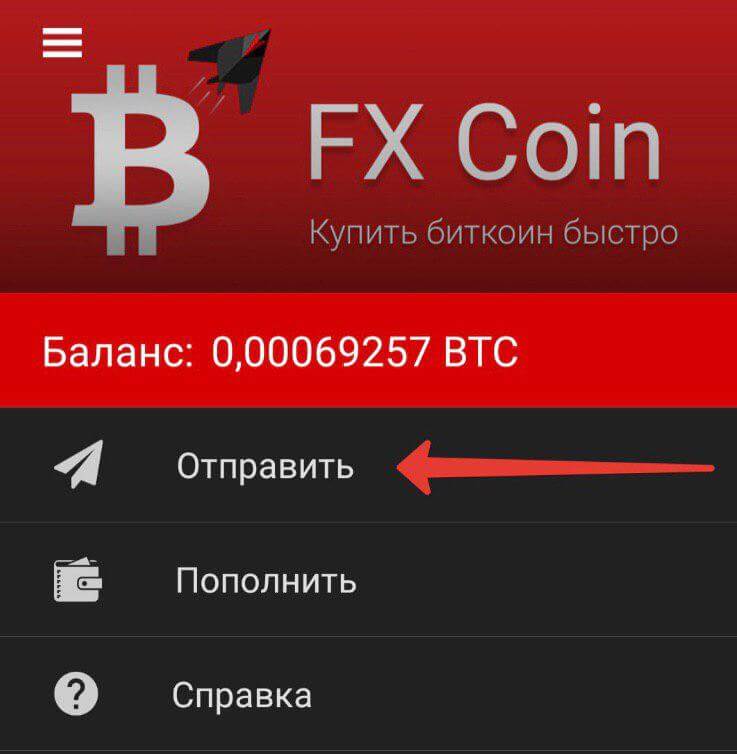

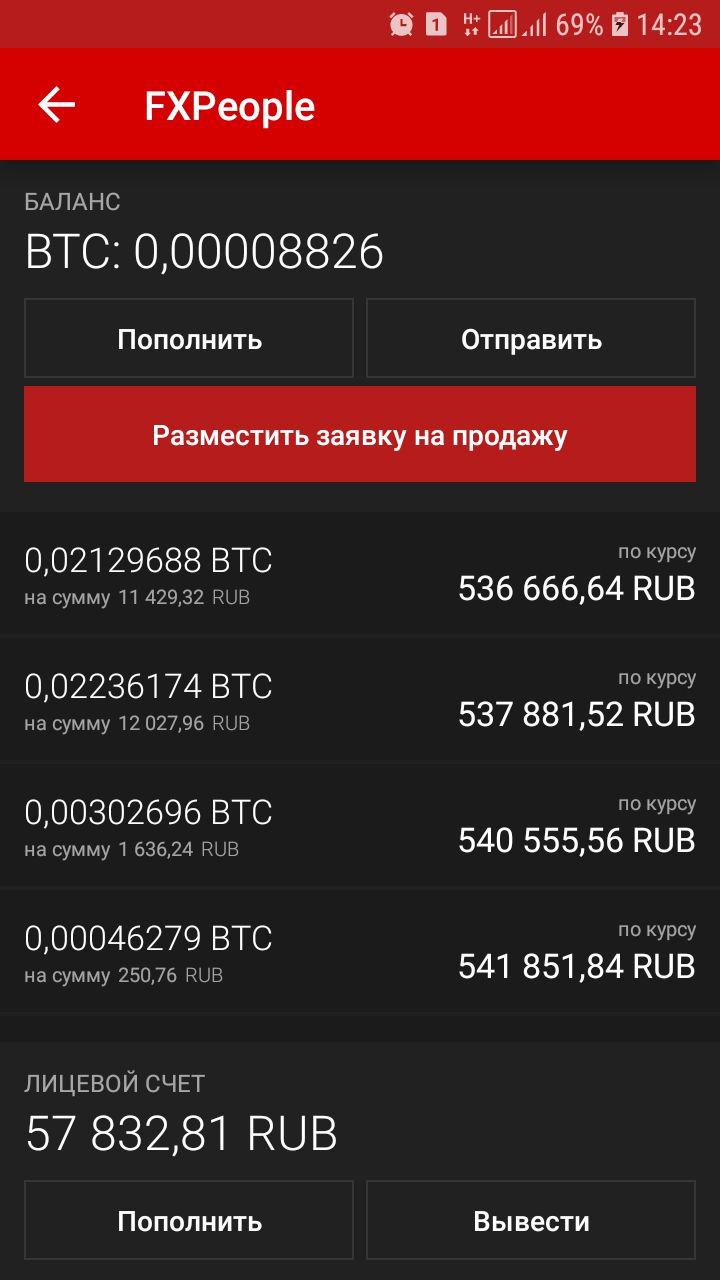

1.1. In this know your client (“KYC”)/anti-money laundering («AML”) policy (Policy) we, DIBF LIMITED incorporated under the Law of England and Wales, Company Number 11262221, having its registered at 210 Shepherds Bush Road, 4 Cambridge Court, London, United Kingdom, W6 7NJ (“Company”), create principles and procedures to identify Company’s customers and prohibit and actively prevent money laundering and any activity that facilitate money laundering or the financing of terrorist or criminal activities. This Policy shall apply to any and all users and customers who wish to purchase Company’s Services (such Services are to be provided under terms of service and other applicable documents located at Company’s Android and IOS Applications (FX Coin) and website https://fxcoin.pro/, including its subdomains) regardless of payment method (fiat currencies, crypto currencies).

1.2. The Company may use, for the purpose of carrying out the activities set forth in this document, the service of the KYC/AML service provider (KYC/AML service provider and/or different service providers that may be engaged by the Company from time to time, collectively, the “KYC/AML Service Provider”).

2. CUSTOMERS DUE DILIGENCE AND “KNOW YOUR CLIENT” IDENTIFICATION PROGRAM

2.1. Company or the person designated by the Company’s Android and IOS Applications (FX Coin) and website https://fxcoin.pro/ ( including its subdomains, the “Application”) to enable the customer to be identified under this Policy based on the following principles: (a) risk-based management to identify and verify identity of each customer, (b) recording of all information and documents of the customer, (c) providing customers with notice that Company will seek identification information to verity customers’ identities, (d) comparing whether the customer with relevant international and national lists of suspected terrorists and/or sanctioned persons.

2.2. High risk countries and questionable origin of client information and/or documents. Company will carry out enhanced due diligence if the customer meets one or several of the following criterions: (a) legal person is incorporation in offshore jurisdiction and/or customer’s shareholder(s) is incorporated in offshore jurisdiction, (b) individual or legal person from high risk country or sanctioned territory (collectively, the “High Risk Countries”), (c) information and/or documents provided by a client during customers due diligence are of questionable origin. In all such cases Company shall take all necessary and reasonable steps to enhance its customers due diligence requirements and procedures which the Company will decide upon according to section 2.3. (g).

Company does not offer or provide Services to customer who/which is a citizen or a resident (tax or otherwise) of a state where Company has decided not to provide its Services, as may be decided from time to time, and to a person included in the Watchlists Databases.

2.3. The customer shall undergo the following risk-based Customer due diligence and KYC identification program which may be carried out by the Company itself or by the person designated (KYC/AML Provider) by the Company:

- (a) customer opens an account at the Application;

- (b) customer fills his/her account with information and documents required under section 2.4 (a) to (i);

- (c) the information submitted by the customer will be transferred to the KYC/AML Service Provider in order to verify customer’s identity according to section 2.4 (i)-(k);

- (d) the KYC/AML Service Provider will review and verify provided information and documents;

- (e) the KYC/AML Service Provider will perform search regarding the customer to the Government Sanctions Lists, Politically Exposed Persons Lists, Anti-Terrorism Watchlists, Anti-Money Laundering (AML) Watchlists, CIA Watchlists, Global Watchlist, Disqualified Directors (collectively the “Watchlists Databases”);

- (f) the KYC/AML Service provider will verify the customer or decline the customer after the customer verification and the search in the Watchlists Databases;

- (g) if the customer meets any of the criterions under section 2.2 then the Company will perform enhanced due diligence based on risk-based approach or refuse such customer in provision of Services and refund to that customer any funds that have been previously deposited by such customer to the account of the originated address in the same type and manner within reasonable time, unless otherwise is provided in this Policy and/or required by the applicable laws and regulations;

- (h) The Company will request additional information and/or documents for customers from high risk countries or if there is information and/or the documents submitted by the customer referring to higher risk of money laundering, terrorist financing and sanctions.

2.4. Once the customer opens an account at the Application the following information and/or documents will be collected for all and any accounts, any person (individual person, entity, company, partnership, incorporation, organization, other form of legal entity/person (“legal person”)) that is opening a new account and whose name is on the account prior to providing any Services to such person, including receiving Company’s services and/or goods (deposit/payment of digital, crypto and/or fiat currencies and/or digital assets does not require prior customers due diligence):

- (a) name;

- (b) date of birth (for an individual person) or date of incorporation (for a legal person);

- (c) citizenship;

- (d) residence;

- (e) gender;

- (f) email;

- (g) phone number;

- (h) address (including the country, state, city and address line);

- (i) information (i.e. document number and document type) regarding the proof of identity (passport, driving license or national identity card that includes picture of a holder) for an individual person;

- (j) photograph of the front and back side of the document and a “selfie” for an individual person or certificate of incorporation, memorandum and articles of association, beneficial owners information and such legal person directors’ identity documents/information provided above and proof of a residential address for a legal person;

- (k) proof of a residential address: electricity, gas, water or other similar utility bill less than three months old or a bank statement for an individual person or a registered address or other location (for a legal person).

The customer could be requested of any other reasonable information and/or documents needed to verify customers identity. Such information and/or documents may be provided via separate message or through any other means used by the Company.

2.5. Based on the risk, that shall be determined on case by case basis, and to the extent reasonable, using risk-based procedures to verify and document all and any information received by the Company in regards to a customer, Company will ensure and make all necessary efforts to form a reasonable belief that Company (a) knows the true identity of a customer and (b) information and documents provided by a customer are accurate and true. Company and KYC/AML Service Provider will analyze all the information and documents received and/or collected from a customer in order to verify whether such information and/or documents are sufficient to form a reasonable belief that Company knows the true identity of a customer. Customer’s identify may be verified through documentary and/or non-documentary (including, electronically) means. Company may use any of appropriate verify method based of each case risks.

When requested by the Company and/or KYC/AML Service Provider all documents to be provided by a customer shall be certified by a lawyer, accountant, notary public or official of customer’s nationality embassy or consulate. In such case certifier must state that a document is a true copy of the original one, and must sign and date each copy of the documents and indicate his/her position or capacity on such documents and provide necessary contact details. This clause shall also apply to any non-English language documents that requires to be translated and certified.

Company will conduct procedures necessary for identity verification within reasonable time after the account is opened, but in all cases prior to providing Services by the Company to such unverified customers. Based on applicable risks and case by case basis, Company may refuse to complete any transaction, including, but not limited to, depositing of funds to customer’s account, before Company verified the information and/or documents in regards to such transaction and/or customer.

2.6. In event the Company and/or KYC/AML Service Provider find suspicious information in information and/or documents provided by a customer that indicated possible money laundering, terrorist financing activity or any other suspicious activity, Company will report the activity in accordance with applicable laws and regulations to the respective authority (if necessary).

2.7. When Company cannot form a reasonable belief that it knows the true identity of a customer (or in regards to a legal person – its beneficial owners and/or directors), Company shall do the following: (a) deactivates customer’s account on the Application, (b) close such an account after multiple attempts to verify customer’s identity has failed, (c) refund to that customer any funds that have been previously deposited by such customer on the account to the originated address (account) in the same type and manner within reasonable time, unless otherwise is provided in this Policy and/or required by the applicable laws and regulations, and (d) determine whether it is necessary to notify authorities when such notification is required by the applicable laws and regulations.

2.8. If the potential or actual customer either refuses to provide any part of the information described above when requested by the Company or Company reasonably believes and/or have found that customer has intentionally provided false, wrong and/or misleading information, then Company will deactivate the account of the customer and consider closing any existing account. Any funds that have been previously deposited by such customer shall be refunded to that customer to the originated address (account) in the same type and manner within reasonable time, unless otherwise is provided in this Policy and/or required by the applicable laws and regulations.

3. RECORDKEEPING

3.1. Company will keep and maintain all and any logs of verifications, including all and any identifying information provided by a customer and third parties as described herein, and all steps and resolutions made by the Company within the identification and verification process. Company will keep and maintain records containing the following:

- (a) in respect to documentary verification — all and any information and documents that Company relied on to identify and verify a customer’s identity;

- (b) in respect to non-documentary verification – all and any information and logs that describe the results of any steps that Company took to verify the identity of a customer;

- (c) in respect to verification based on third party verifying services provider – information of customer’s verification status and logs/messages between Company and such third party in regards to such customer.

All and any information to be kept in regards to customers verifications are highly confidential and will not be provided by the Company to any third party, unless otherwise is specified herein or prescribed by applicable laws and regulations.

4. ANTI-MONEY LAUNDERING PROGRAM

4.1. Company adheres to the principles of Anti-Money Laundering and actively prevents any actions that aim or facilitate the process of legalizing of illegally gained funds. To perform it Company monitoring and analyzing all transactions made by clients in Company’s services automatically. Company performs a variety of compliance-related tasks, including capturing data, filtering, record-keeping, investigation management, and reporting.

4.2. Services includes following AML functionality:

- Turnover limits. Company limiting maximum sum of transaction, daily and monthly turnover for every Customer, not allowing to perform transaction with sum exceeding the limits.

- Filters. Company analyzing all transaction data of its Clients like card numbers, ip-addresses, etc. Filters function automatically not allowing to perform transaction in case of transaction data would find suspicious.

- Blacklists. Filtered transactions are analyzing by Company officer and transaction data, which were found suspicious will be put in Blacklist. For every case

4.3. Company monitoring all transactions and have the right to ensure that transactions of suspicious nature (including Filtered and Blacklisted transactions) are reported to the proper law enforcement through the Company Officer; request the Customer to provide any additional information and documents in case of suspicious transactions; block Customer’s account in case of suspicion that such Customer engaged in illegal activity.

4.4. To prevent money laundering, Company not accepts cash under any circumstances.

4.5. Company will improve its AML program basing on compliance with current AML regulations.